If you are in that elite group of folks, like me, who are about to turn 65, you are no doubt being bombarded by robocalls and junk email imploring you to sign up for a Medicare supplement plan of some kind to augment the coverage Medicare provides. And of course if you watch daytime television, just about every hour there is some Medicare coverage plan being advertised, especially during the enrollment period. They like to use the word "free" a lot. This article is not about detailing choices for you, because I am no more than another fish swimming in the Medicare sea, with no special knowledge. There are others sources far more knowledgeable than I am.

For more in depth information I would urge those who need it to log onto www.medicare.gov, or simply call your Medicare office for specific information. I would not go online and give personal information like phone numbers or email addresses some of these companies advertising on TV. Expect to be deluged with calls, texts and emails if you do.

My goal here is to discuss my own recent experience, and some of the steps that I took to get answers to my questions. My situation will not be the same as yours, so your choices will be different. But I would advise everyone to go directly to the source first, that is Medicare or Social Security. If you don't have one, sign up for a secure account on their websites, and keep passwords safe and secured.

I retired early from teaching at age 62; while teaching I enjoyed a relatively low cost, school-district subsidized health insurance through one of the major healthcare providers . I was in relatively good health and on a PPO plan; I liked my doctor and the plan benefits, so naturally it was a no-brainer for me to continue paying on my own through the pre-Medicare years of my retirement. Also, knowing the political uncertainties in ACA, that decision seemed like a safer, though more expensive choice. And expensive it was; my monthly premiums in retirement, even with a supplement from my state's pension system, was nearly $700 a month. That's a far cry from the $120 a month single coverage I enjoyed as a fulltime school employee.

But this is a a lament that so many retired teachers and other government workers have had to voice, and I was not supporting a family anymore. If I had been on a family plan, my monthly costs would have been well over $1000 monthly. So obviously, I was very anxious to learn how Medicare coverage would reduce my monthly healthcare costs. I had been able to deduct my premiums on my tax returns, thankfully, but it still has been expensive.

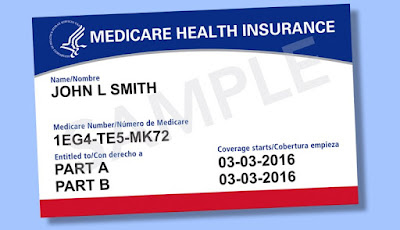

There are a lot of terms and phrases that that you have to become familiar with, starting with Original Medicare, enrollment periods, Medicare Parts A, B, C and D, Medicare supplemental plans, Medigap plans, Medicare Advantage plans, HMO, PPO plans inclusive. There is so much more. What were these plans, and how could I tell what was best for me?

I actually started my search on YouTube. Being a visual learner, I found many channels there which helped me to define better what my choices were, and where I was currently. In addition, my state retirement board and Social Security had each mailed packets of good information, which I used to further refine my knowledge. Going on the Medicare site also provided a great deal of background material that I knew I would need.

Ultimately, what helped me most was being a member of AARP. Through them I learned that my own healthcare company offered several AARP-endorsed Medicare plans to cover Part C and D, plus dental and vision. I obtained spreadsheets from other companies too, and finally decided to contact my insurance company directly, working though a local agent. I settled on one of their PPO Medicare Advantage plans that seemed closest to what I was already paying for, at a fraction of my current cost, beginning on the first of my birth month. Ironically as I was recently working with my agent over a Zoom call, my Medicare card actually arrived. Social Security had automatically enrolled me 90 days ahead of my birthday.

There are a lot of details here which informed my choices, but I don't want to get bogged down in them because my situation probably won't apply to others. I'll just say that there is no need to feel apprehensive about the process. There is simply too much information material available to throw up your hands. Reach out to the government agencies. If you are a phone person, you can easily find a person-to-person contact there to help you. If you are like me, I like to compare visual information, so online resources worked best. At the very least, you can contact your own healthcare provider for answers.

The best thing about Medicare coverage is that you are not forever locked into a plan. If a specific plan isn't working for you, it can be changed during the next enrollment period. Ultimately we are responsible for our own choices; if we have the best information available, we are in a much better position to make good choices. Good luck!

No comments:

Post a Comment